The Complete 2025 Global Report: Video Animation Market Growth, Trends & Forecast (Industry Breakdown by Region & Sector)

The global video animation industry has entered one of the largest expansion phases in its history. As of 2025, animation is no longer limited to entertainment and film — it has become a critical tool in healthcare, advertising, manufacturing, education, real estate, e-learning, and corporate training. Advancements in AI-assisted animation, motion capture, photorealistic rendering and immersive VR experiences are accelerating adoption across multiple sectors.

[web_stories title=”true” excerpt=”false” author=”false” date=”false” archive_link=”true” archive_link_label=”All Web Stories” circle_size=”150″ sharp_corners=”true” image_alignment=”left” number_of_columns=”1″ number_of_stories=”8″ order=”DESC” orderby=”post_title” view=”carousel” /]

Key 2025 highlights at a glance:

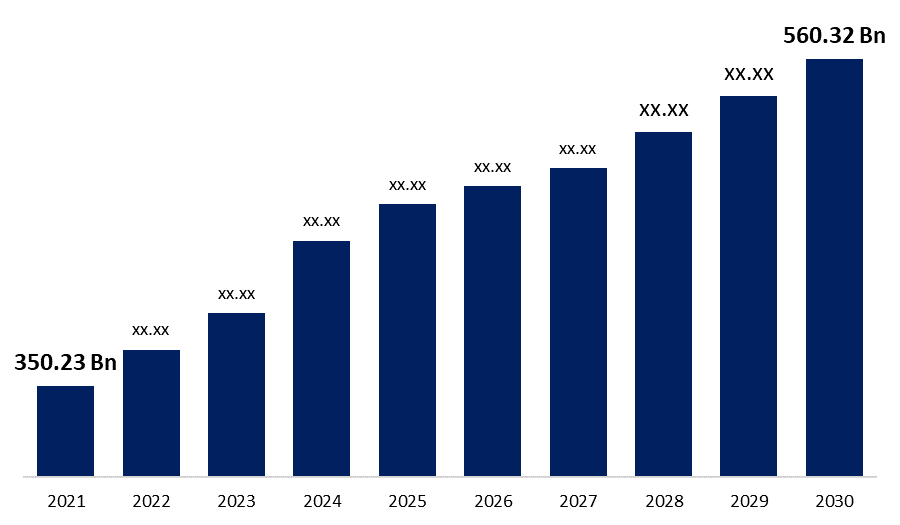

–>The global video animation market is expected to grow at a strong CAGR through 2030.

–>The highest demand comes from healthcare, real estate, education, and advertising.

–>3D animation surpasses 2D animation in enterprise adoption.

–>AI and real-time rendering dramatically reduce production time.

–>Businesses are shifting budgets from traditional video shooting to digital animation.

This report presents the current market valuation, regional demand patterns, industry use cases, technology trends, cost shifts, and projections for 2025–2030.

1. Global Animation Market Size & Revenue Analysis (2025 Snapshot)

The animation market experienced a period of rapid maturity over the last decade. In 2025, animation has become a mainstream visual communication tool across industries due to its ability to simplify complex messages, increase customer engagement and reduce production costs vs live filming.

2025 Revenue Overview

The market includes the following segments:

–>2D animation

–>3D animation

–>Motion graphics

–>VFX and CGI

–>AR & VR immersive visuals

–>Real-time animation for simulation & training

Each segment contributes significant value, with enterprise-grade 3D animation showing the highest revenue jump. Industries increasingly look at animation as a long-term digital asset rather than a one-time commercial video.

Projected CAGR Growth Through 2030

Factors contributing to continued growth:

–>Expanding global digital learning market

–>Rise of 3D product visualization in e-commerce

–>Safety & workplace training standardization

–>Rapid adoption of virtual real estate showcasing

–>Medical visualization becoming mainstream for patients and students

–>Corporate demand for animated marketing collateral

Animation is no longer seasonal or campaign-based; it has become a sustained communication model for brands and organizations.

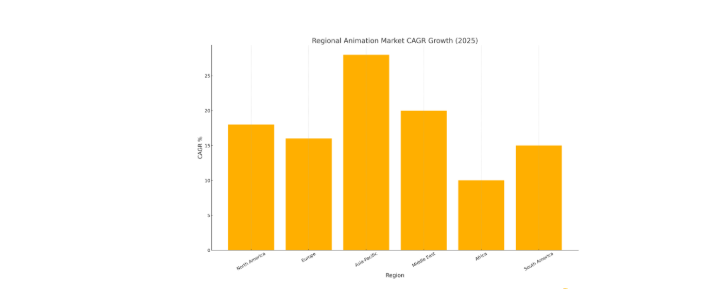

2. Regional Market Assessment

Every region of the world is experiencing a rise in animation demand, but growth drivers vary by geography.

North America

–>Mature animation market led by entertainment, gaming, pharma and SaaS.

–>High demand for 3D animation in product launches, medical education and brand marketing.

–>Large budgets and high competition encourage innovation in hyper-realistic visuals.

Europe

–>Rapid adoption across real estate, healthcare, energy and corporate communications.

–>Enterprises embrace animation for sustainability education, safety training and manufacturing walkthroughs.

–>Motion graphics and multilingual e-learning animation are in high demand.

Asia-Pacific

–>The fastest-growing animation-consuming region in 2025.

–>India becoming a global hub for production outsourcing.

–>Japan and South Korea dominate gaming and anime content growth, while Singapore and Hong Kong invest in enterprise visualization.

Middle East

–>Major investment in architectural visualization, interior design previews and smart city projects.

–>Widespread adoption of industrial safety animation, refinery training simulations and corporate brand launch videos.

–>Dubai and Riyadh emerge as leading animation buyers.

Africa

–>Growing demand for animated educational content for public health, schools and e-learning initiatives.

–>Government programs increasingly allocate budgets to digital learning.

South America

–>Strong adoption in corporate training, safety training and marketing animation.

–>Marketing agencies drive nationwide demand for 2D & 3D explainer videos.

3. Industry-Wise Demand Breakdown (2025)

The animation market is no longer dominated by entertainment. Enterprise usage now accounts for the majority of global animation spending.

Top industries actively investing in animation in 2025

| Industry | Key Applications |

|---|---|

| Healthcare & Pharma | Surgical animations, MOA videos, patient education |

| Real Estate | 3D walkthroughs, virtual tours, photorealistic visualization |

| Education & e-Learning | Course modules, augmented classrooms, VR simulations |

| Manufacturing & Engineering | Industrial safety training, plant visualization, product demos |

| Retail & eCommerce | 3D product configurators, CGI promotional ads |

| Advertising & Branding | Digital campaigns, brand films, product launch videos |

| Aviation & Aerospace | Simulation training and engineering communication |

Why enterprises are shifting to animation

–>No need for large production crews

–>Easier localization for multilingual global audiences

–>Complete creative control without reshoots

–>Ability to visualize things that cameras cannot capture

–>Higher viewer retention vs live-action content

4. Technology Trends Transforming the Animation Landscape in 2025

The most significant innovation wave in animation is AI-empowered and real-time content production.

Key 2025 technological shifts

🔹 AI-assisted keyframing and motion automation — reducing manual timeline work

🔹 Real-time rendering with Unreal Engine & Unity — instant photoreal feedback

🔹 Motion capture democratization — full-body tracking with affordable equipment

🔹 Volumetric video & digital twins — used across healthcare and manufacturing

🔹 Cloud-based render farms — delivering heavy processing without hardware barriers

🔹 AI-powered voice synthesis — instant multilingual dubbing and voice-over

Long-term impact

Production speed is increasing dramatically while output quality is improving. As a result, many companies now prefer animation over traditional video shoots due to more control, scalability and lower long-term cost.

5. Cost & Budget Shifts in 2025

The economics of animation have transformed because technology is reducing time-to-production.

Why budgets are increasing

–>Businesses now create recurring animated content rather than one-time videos.

–>Animation helps centralize training, product marketing and onboarding.

–>Real estate and industrial companies use repeated visual updates for new projects.

Where costs are decreasing

–>3D animation no longer requires expensive rendering infrastructure.

–>AI workflows eliminate time-consuming manual labor.

–>Animation reuse — brands can update assets instead of recreating them.

Conclusion: Value and dependence on animation are rising, while production costs become more predictable.

6. Forecast for 2025–2030

The next five years will reshape the global animation market more than the previous ten.

Expected developments

–>Customized learning experiences using interactive animated avatars

–>Product digitization — every physical product will have a 3D marketing equivalent

–>Virtual real estate marketplaces replacing physical showrooms

–>Corporate safety compliance becoming 100% digital and simulation-based

–>Medical education merging with VR anatomy labs

–>Advertising shifting to CGI-based storytelling over live filming

What this means for businesses

Organizations that adopt animation early will have a competitive edge in:

–>Customer education

–>Brand differentiation

–>Employee upskilling

–>Cost-efficient global communication

Animation will become a default corporate communication language across sectors.

7. Opportunities & Challenges

Opportunities

✔ Animation drives higher engagement and learning retention

✔ Eliminates the need for expensive film production infrastructure

✔ Delivers consistency across global audiences

Challenges

⚠ Skill shortage in real-time 3D and AI-animation specialists

⚠ Rising expectations for realism and creativity

⚠ Need for systems to manage digital assets at scale

Organizations planning long-term animation adoption must invest in:

–>Talent partnerships

–>Scalable production pipelines

–>Asset library management

8. Key Takeaways (Bullet Format for Media Citation)

–>Animation has transitioned from entertainment to core business communication.

–>Healthcare, real estate, education, industrial training and advertising are the five largest animation-buying sectors in 2025.

–>Real-time rendering and AI are dramatically reducing production timelines and costs.

–>The animation market shows steady global growth through 2030.

–>3D animation adoption surpasses 2D animation in enterprise applications.

–>Organizations using animation for training & marketing experience higher ROI and engagement than traditional video.

2025 marks a turning point in how organizations communicate and educate. The demand for photoreal animation, interactive product visualization and immersive training content continues rising across the globe. With technology accelerating workflows and reducing cost barriers, animation has evolved into an essential long-term digital investment for modern businesses.

The next five years will not be defined by if companies use animation — but how intelligently they apply it to communication, learning and brand strategy.

For faster response contact on WhatsApp